Measuring the Credit Score

It no longer surprises me that most lending managers and staff know so little about the scores they are using or how to measure, change or statistically analyze their performance. When consulting with lending managers having issues with credit scores many times I would begin a meeting by asking them a simple question.

What is the average credit score of your paying loans granted in the past year?

After a few guesses that the average score was “about 650” or so it would become apparent that the number may or may not be accurate. So I would ask a second question.

What is the average score of last years’ charged off loans?

Usually that question would not even elicit a response.

Often we would be retained to collect and sort the scores. After arranging the scores for paying and nonpaying loans separately a comparison would often reveal the average score of paying loans to be 664 and the average score of nonpaying loans to be 659.

There would be no measureable difference in the median scores of paying and nonpaying loans. The credit score didn’t predict risk at all. Try this yourself with your loans from last year.

Here’s the issue. If you don’t know where the middle is on a range of scores you can only generally estimate if the application you are considering today is average, below average or above average.

Distribution Charts

One important method of evaluating any score is to rank order the number and percentage of scores in each risk category from highest to lowest. The result will display the percent of loans in each score range--- a distribution chart.

There are two important factors to observe in a distribution chart. One is the range where the median, or middle, score is located. What score range represents the center of the scale where approximately 50% of the scores are higher and 50% are lower?

The median will tell you what scores represent the “average” borrower. Applications with scores below the median will be a higher than average risk. Scores above the median are less than average risk. To begin to make any credit decision it is essential to know how the application for the loan compares to the median score.

A second aspect of a distribution is the consistency in each score range. How much the percentages within a score range vary from one reporting period to the next. Comparing the percentages will determine trends of the scores either up or down.

The cumulative frequency distribution chart compares the percentages of paying and nonpaying loans in each score range by 50-point increments. The sample is based on 17,887 paying and 2,023 nonpaying loans. The median score of paying loans is within the range of 651-700 points and median nonpaying in the 351-400 range.

Cut off scores for underwriting and pricing are developed from the distribution percentages. Distribution charts can be developed for individual products or loan segments.

Product Repayment Ratios

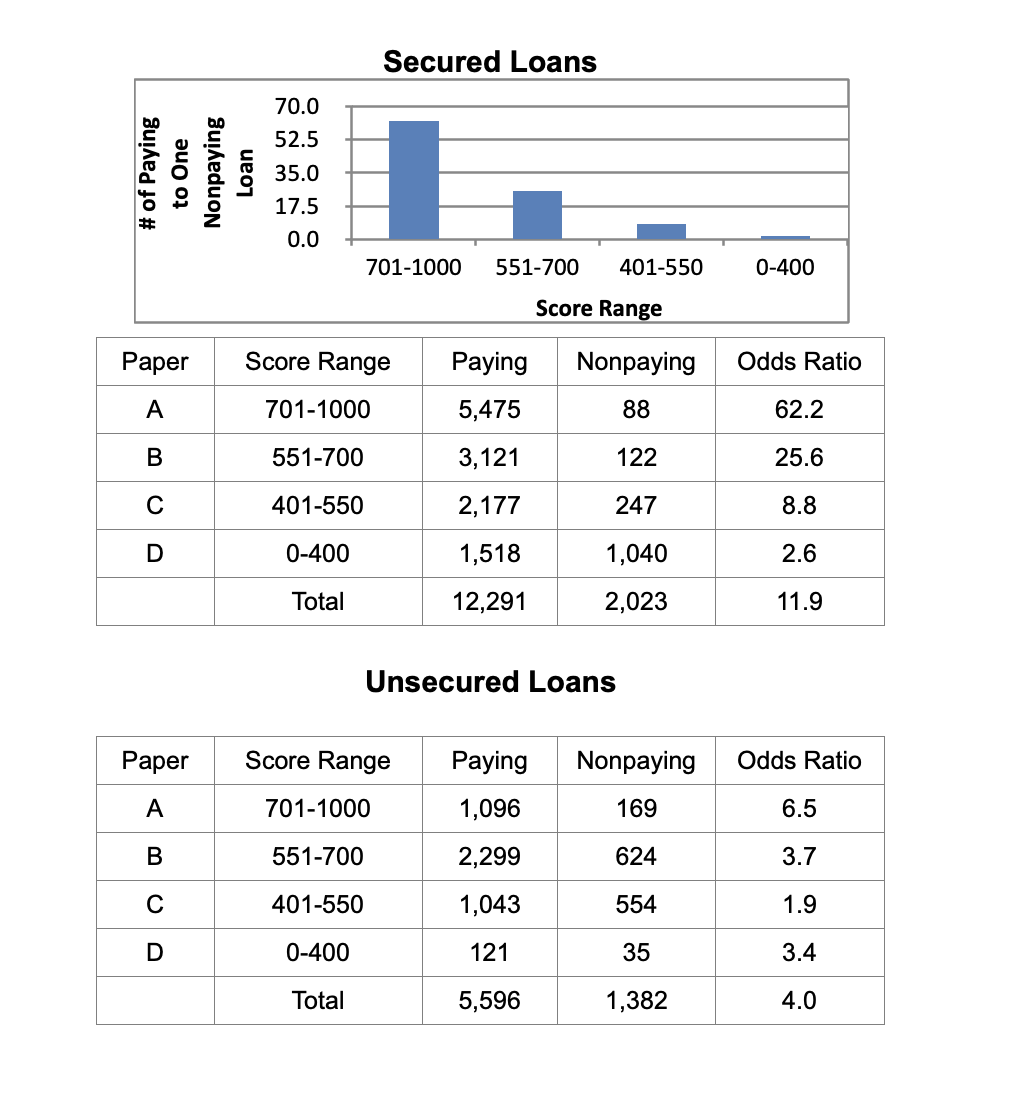

Another method of measuring Hybrid credit scores from a data extract is by repayment or odds ratios. How many paying loans are there for every one nonpaying loan in each score range? For this illustration we will simplify the products into secured and unsecured loans.

Secured loans are vehicles, boats, motorcycles and any other loan product that allows a margin of safety because the lender retains ownership and the right of recovery. Unsecured loans and credit cards are based on promissory agreements and require only a signature for funding.

Loss Ratios based on the extract data file can be measured by calculating the percentage of the original loan amount to the dollar amount of loans charged off in each score range. Unacceptable loss ratios may require adjustments to lending guidelines to increase loan limits or apply higher interest rates in some ranges.

Product Profitability Example

Data included in the Hybrid extract file permits an analysis of profitability by either credit score or portfolio segments.

To obtain an estimate and proposal for converting your current credit score lending program to a Hybrid scoring system contact sales@creditscorelending.com.